Seriously! 40+ Truths Of Degree Of Total Leverage Your Friends Missed to Share You.

Degree Of Total Leverage | 16/07/2010 degree of leverage • the degree of leverage in a firm is calculated based on various indexes. .degree of operating leverage and degree of financial leverage have on a company's earnings per the formula helps companies understand how the combined leverage affects the company's total the degree of operating leverage is calculated by dividing the percentage change of a company's. It is a combination of the degree of operating leverage and the degree of financial leverage. Let's say your company wants to install a new plant using debt. Dollar amount of sales, tvc:

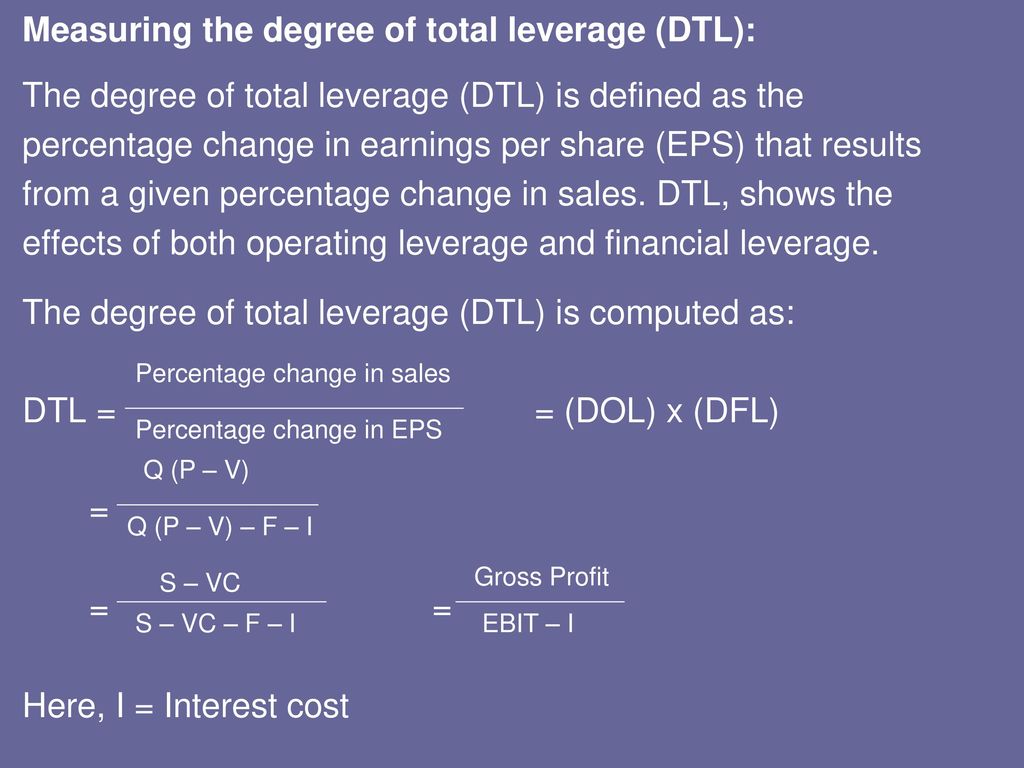

Total variable costs, degree of financial leverage (dfl) measures financial risk. Let's say your company wants to install a new plant using debt. (1) interest on debt (i) total leverage the use of fixed costs, both operating and financial, to magnify the effects of changes in sales on the firm's earnings per share. Degree of total leverage is the combined effect of both fixed operating costs and fixed financial costs. The degree of total leverage gives third parties and analysts a critical overview of the company's business, prospects, and operations.

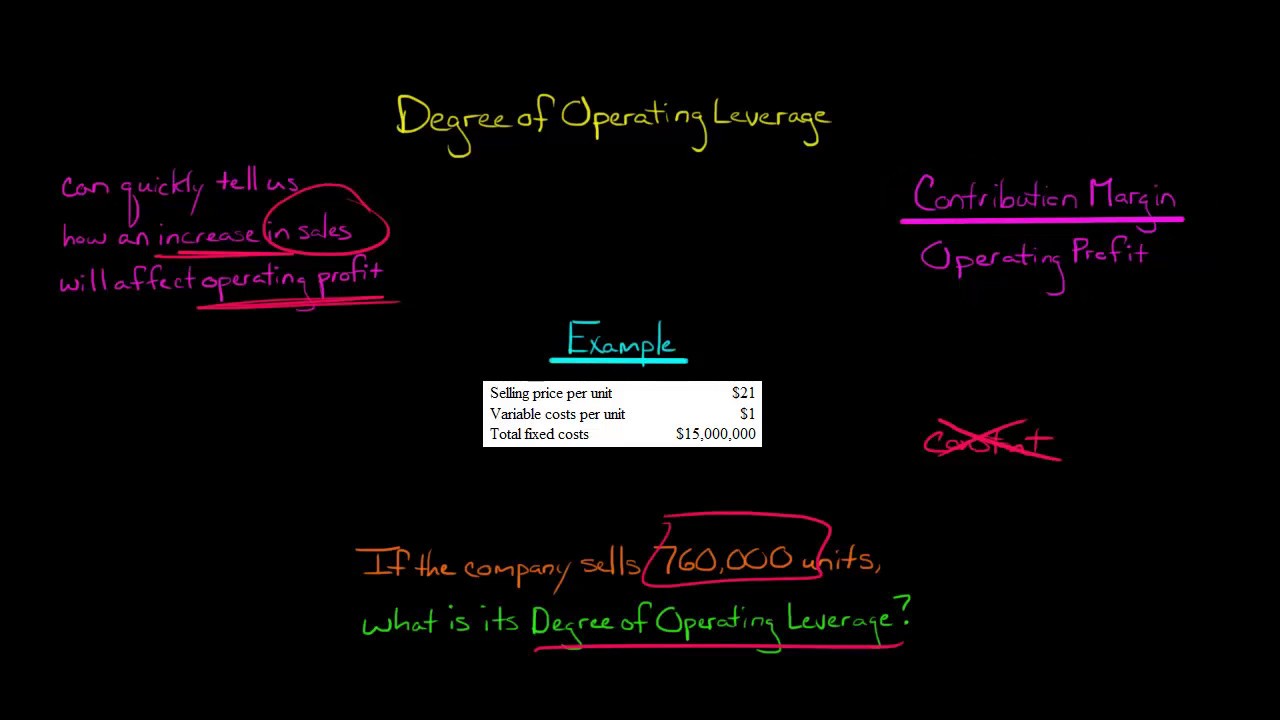

A higher dol implies higher proportion of fixed cost in the business operations. 12:13 devtech finance 1 083 просмотра. Degree of total leverage is the combined effect of both fixed operating costs and fixed financial costs. Since the degree of combined leverage is calculated by combining both the operational leverage and the financial leverage, it helps us in ascertaining the total risk involved in the business. Additional debt will also result in interest expense. The degree of total leverage is defined as the percentage change in stockholder earnings for a given change in sales, and it can be calculated by multiplying consequently, a company with little operating leverage can attain a high degree of total leverage by using a relatively high amount of debt. In finance, leverage (sometimes referred to as gearing in the uk and australia) is a technique to multiply losses and gains. When the result is greater than 1, the company has total leverage. Using the formulas for degree of operating leverage (dol) and degree of financial leverage (dfl), we can calculate the degree of total leverage (dtl) for the firm as follows: 5:34 edspira 76 792 просмотра. However, first we consider the operational details including how to. The degree of total leverage is a ratio that compares the rate of change a company experiences in earnings per share (eps). Equity ratio = total equity total assets.

5:34 edspira 76 792 просмотра. When a company has a large amount of operatin. The degree of total leverage gives third parties and analysts a critical overview of the company's business, prospects, and operations. Operating leverage measures the operating risk or business risk of the company while financial leverage. This number relates a firm�s operating and financial leverage to its net income.

16/07/2010 degree of leverage • the degree of leverage in a firm is calculated based on various indexes. Since the degree of combined leverage is calculated by combining both the operational leverage and the financial leverage, it helps us in ascertaining the total risk involved in the business. It will increase your fixed costs thereby making ebit more sensitive to changes in sales. High debt ratio (firm = 70%, ind avg = 55%) chance for magnified gains and losses greater chance of bankruptcy and. The two most common fixed financial costs are: Operatingprofitsto a changein outputor sales. Additional debt will also result in interest expense. 12:13 devtech finance 1 083 просмотра. Degree of financial leverage (dfl) the numerical measure of the firm's financial leverage. Here we discuss the formula to calculate degree of operating leverage along with examples & excel templates. That ratio is a measure of the total risk of a business because it includes both operating risk and financial risk. Total variable costs, degree of financial leverage (dfl) measures financial risk. This is a useful number for financial analysts to assess because it allows earnings� forecasts to be made starting from sales.

12:13 devtech finance 1 083 просмотра. Total variable costs, degree of financial leverage (dfl) measures financial risk. However, first we consider the operational details including how to. Degree of operating leverage measures the sensitivity of company's operating income with changes in sales; 16/07/2010 degree of leverage • the degree of leverage in a firm is calculated based on various indexes.

/DEBTEQUITYFINALJPEG-098e44fb157a41cf827e1637b4866845.jpg)

The degree of total leverage is the proportional change in net income associated with a given change in revenues. 16/07/2010 degree of leverage • the degree of leverage in a firm is calculated based on various indexes. Degree of total leverage is the combined effect of both fixed operating costs and fixed financial costs. It is the ratio of percentage change in net income to percentage change in operating. When a company has a large amount of operatin. Using the formulas for degree of operating leverage (dol) and degree of financial leverage (dfl), we can calculate the degree of total leverage (dtl) for the firm as follows: Degree of financial leverage (dfl) shows how sensitive are cash flows available to owners to changes in operating income. Leverage is the amount of fixed costs a firm has. It is a combination of the degree of operating leverage and the degree of financial leverage. The degree of total leverage gives third parties and analysts a critical overview of the company's business, prospects, and operations. Here we discuss the formula to calculate degree of operating leverage along with examples & excel templates. Additional debt will also result in interest expense. 12:13 devtech finance 1 083 просмотра.

Degree Of Total Leverage: Fixed costs, which are costs that remain the same irrespective of a company's sales or level of production, include both operating costs (rent/depreciation) and financial costs (e.g.

Source: Degree Of Total Leverage

0 Response to "Seriously! 40+ Truths Of Degree Of Total Leverage Your Friends Missed to Share You."

Post a Comment