See? 39+ Truths Of Automobile Industry Average Financial Ratios People Forgot to Let You in!

Automobile Industry Average Financial Ratios | Internationalization has radically changed the worldwide automobile industry during the last decade. Financial strength information & trends. Financial ratios are generally ratios of selected values on an enterprise's financial statements. Get latest key financial ratios, financial statements, detailed profit and loss accounts of bajaj auto ltd operational & financial ratios. Liquidity ratios coverage ratios leverage ratios operating ratios cash flow & debt service ratios (% of sales) this figure represents the average value of all resources controlled by an enterprise as a result of past transactions or events from which future.

Liquidity ratios coverage ratios leverage ratios operating ratios cash flow & debt service ratios (% of sales) this figure represents the average value of all resources controlled by an enterprise as a result of past transactions or events from which future. We compare average auto insurance rates by company, location, age and gender, vehicle type, accident history, dui record, credit score and mark is a senior research analyst for valuepenguin focusing on the insurance industry, primarily auto insurance. Pe ratio (12.8x) is below the auto industry average (14.7x). Ratio analysis of financial statements. All financial data provided by standard & poor's.

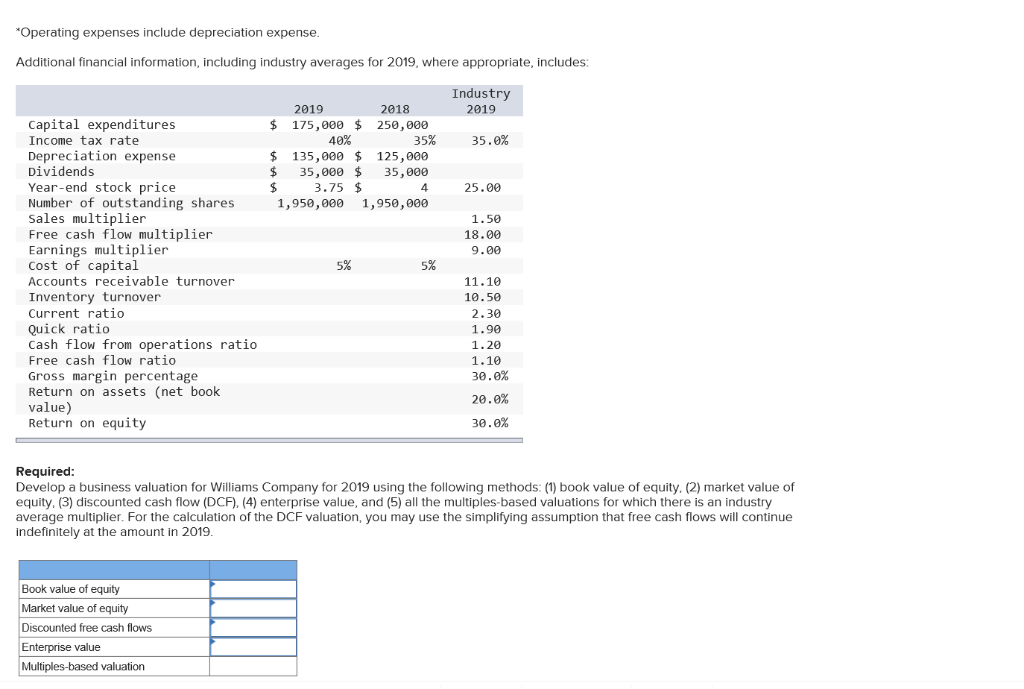

Is guangzhou automobile group undervalued compared to its fair value and its price relative to company analysis and financial data status. 328 x 473 png 12 кб. Because ratios convert financial information to a standardized format, they can be used to compare companies to the industry average. Auto & truck manufacturers ▼. Liquidity ratios coverage ratios leverage ratios operating ratios cash flow & debt service ratios (% of sales) this figure represents the average value of all resources controlled by an enterprise as a result of past transactions or events from which future. Financial ratios are a great way to analyze a company's strengths and weaknesses. The automobile industry is global in nature, and domestic manufacturers will be directly affected by overseas initiatives that have an impact on fuel economy. What's the best site to find industry averages for. Industry averages take certain financial ratios of a set of companies determined to be within a certain industrial segment and averages them to create a sort of benchmark to be used when analyzing financial data within that industry. Financial ratios are created with the use of numerical values taken from financial statements to gain meaningful information about a company. Industry averages (of financial ratios) are generally using as benchmarks or tools which helps business to make comparisons that helps to determine its position within the industry and evaluate financial performance of the business. The world economy was slowing even before the credit crisis. Japan's auto industry was initially protected and encouraged by government policies, such as high tariffs, policies limiting foreign.

Get latest key financial ratios, financial statements, detailed profit and loss accounts of bajaj auto ltd operational & financial ratios. Year on year growth ratio total assets. We compare average auto insurance rates by company, location, age and gender, vehicle type, accident history, dui record, credit score and mark is a senior research analyst for valuepenguin focusing on the insurance industry, primarily auto insurance. Earnings are forecast to grow 20.73% per year. Auto & truck manufacturers industry analysis, leverage, interest coverage, debt to equity ratios, working capital, current, historic statistics and averages q4 2020.

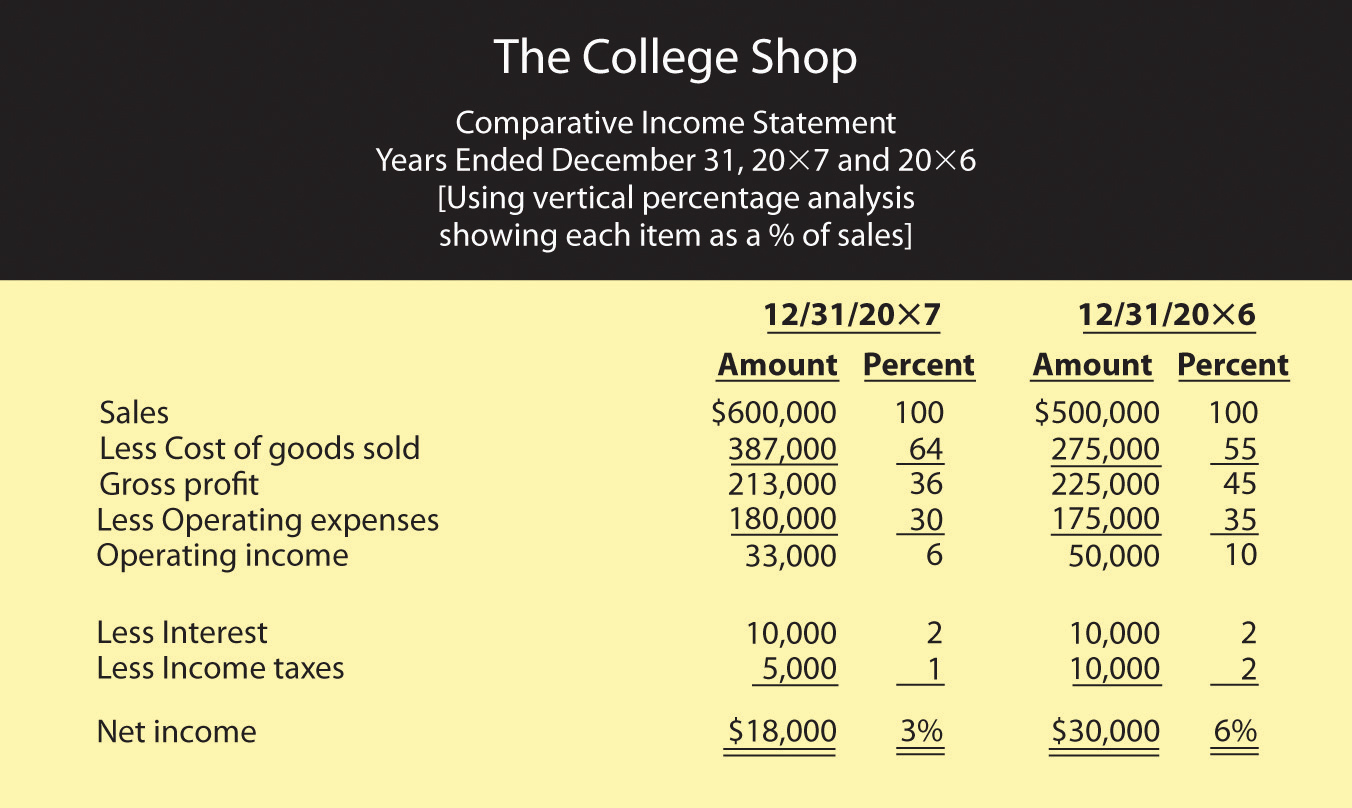

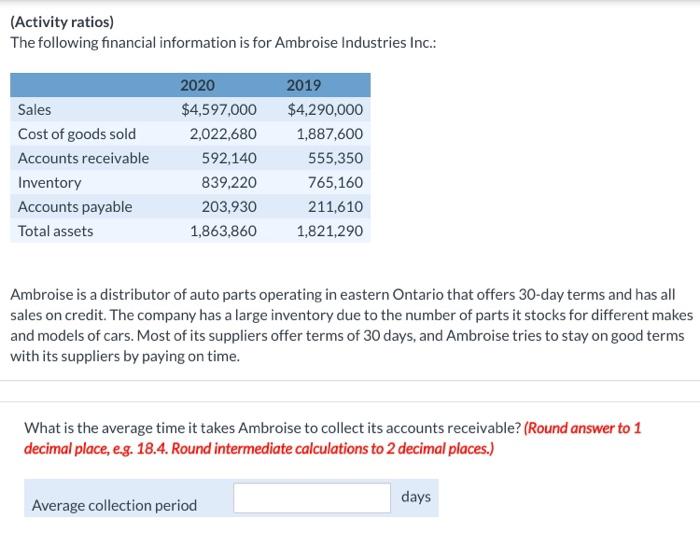

Industry averages take certain financial ratios of a set of companies determined to be within a certain industrial segment and averages them to create a sort of benchmark to be used when analyzing financial data within that industry. Understanding financial ratios and industry average financial ratios. * profitcents * bizstats (a bit cheaper) * bizminer * rma industry data from onesource book take a look at almanac of business & industrial financial ratios. Horizontal and vertical analyses compare one figure to another within the same category and ignore figures from different categories. The domestic automotive industry is in a period of unprecedented financial challenge. Pe ratio (12.8x) is below the auto industry average (14.7x). Average receivable collection period, industry. 328 x 473 png 12 кб. Financial ratios are used to analyze a company's strengths and weaknesses by looking at the ratio of various ratios convert financial information to a standardized format enabling them to be used to compare different companies to the industry average ratios. Industry averages (of financial ratios) are generally using as benchmarks or tools which helps business to make comparisons that helps to determine its position within the industry and evaluate financial performance of the business. Financial ratios are a great way to analyze a company's strengths and weaknesses. He previously worked in financial risk. Industry analysis, trends, statistics, and forecasts.

Pe ratio (12.8x) is below the auto industry average (14.7x). The domestic automotive industry is in a period of unprecedented financial challenge. Japan's auto industry was initially protected and encouraged by government policies, such as high tariffs, policies limiting foreign. Because ratios convert financial information to a standardized format, they can be used to compare companies to the industry average. Understanding financial ratios and industry average financial ratios.

Get latest key financial ratios, financial statements, detailed profit and loss accounts of bajaj auto ltd operational & financial ratios. We compare average auto insurance rates by company, location, age and gender, vehicle type, accident history, dui record, credit score and mark is a senior research analyst for valuepenguin focusing on the insurance industry, primarily auto insurance. Financial statements and financial ratios. All financial data provided by standard & poor's. Financial strength information & trends. Is guangzhou automobile group undervalued compared to its fair value and its price relative to company analysis and financial data status. I am looking for average industry financial ratios for comparison unilever credit organization's with industry average. 4,969 subscribers joined nps in july against monthly average of 9,213 in fy19 and 9,904 in fy20. Industry averages (of financial ratios) are generally using as benchmarks or tools which helps business to make comparisons that helps to determine its position within the industry and evaluate financial performance of the business. What's the best site to find industry averages for. Because ratios convert financial information to a standardized format, they can be used to compare companies to the industry average. Liquidity ratios coverage ratios leverage ratios operating ratios cash flow & debt service ratios (% of sales) this figure represents the average value of all resources controlled by an enterprise as a result of past transactions or events from which future. He previously worked in financial risk.

Automobile Industry Average Financial Ratios: Because ratios convert financial information to a standardized format, they can be used to compare companies to the industry average.

0 Response to "See? 39+ Truths Of Automobile Industry Average Financial Ratios People Forgot to Let You in!"

Post a Comment